On 23 Jul 2024 FM Nirmala Sitharaman presented Union Budget. FM introduced a innovative scheme, NPS Vatsalya, designed to secure your child’s financial future.

This new plan allows parents or legal guardians to open an NPS account for their minor children, encouraging long-term savings and retirement planning. As it is well know in investing that as early you start investing the more you gain in future and increase you retirement happiness.

What is NPS Vatsalya

NPS Vatsalya (NPSV) is a by-product of the National Pension System (NPS), designed specifically for minors. NPSV operates on the principle of early investment for significant compounding returns. By regular investment to the child’s NPS account, Guardians can build a good corpus by the time the child become adult. By doing this Kids are learning investing habits in early age.

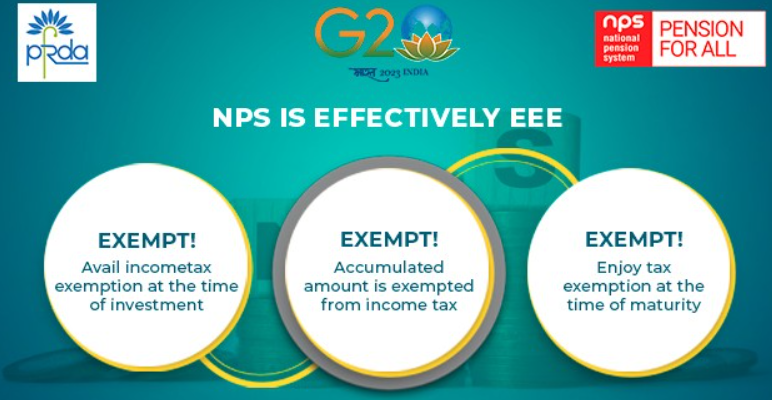

Tax benefits NPS Vatsalya

These are tax benefits under various sections for the guardian or parents:

Section 80CCD(1)

Parents or guardians can claim contributions as a deduction under Section 80CCD(1), up to 10% of the salary (Basic + DA) or 20% of the gross income for self-employed individuals. This amount comes within the overall limit of ₹1.5 lakh under Section 80CCE.

Section 80CCD(1B)

Under section 80CCD(1B) an additional deduction of up to ₹50,000 is available over and above the standard limit of ₹1.5 lakh.

Section 80CCD(2)

Employers can claim a deduction of up to 14% of salary (for Central Government employees) or 10% for others, for their contributions under Section 80CCD(2). This deduction is separate from the ₹1.5 lakh limit set by Section 80CCE.

Capital Appreciation Tool

NPS Vatsalya is a kind of small savings which can generate big capital appreciation for it’s holders. Lets explore the available options of Investement for the funds collected trough NPS

There are two choice of investing the money received into NPS Vatsalya:

Active Choice

Subscribers can choose the allocation among the different asset classes like Equity, Corporate Debt, Government Bonds and Alternative investments (E, C, G,A) based on their risk appetite. This option allows for more control over the portfolio of the investment.

Equity Allocation Matrix for Active Choice

| Age (Years) | Max. Equity Allocation |

| Upto 50 | 75% |

| 51 | 72.5% |

| 52 | 72% |

| 53 | 67.5% |

| 54 | 65% |

| 55 | 62.5% |

| 56 | 60% |

| 57 | 57.5% |

| 58 | 55% |

| 59 | 52.5% |

| 60 & Above | 50% |

Auto Choice

The allocation among asset classes is done automatically based on the subscriber’s age. There are three lifecycle funds under Auto Choice:

LC75 (Aggressive Lifecycle Fund)

This Life cycle fund provides a capping of 75% of the total assets for equity investment. The exposure in equity investments starts with 75% till 35 years of age and gradually reduces as per the age of the subscriber.

LC50 (Moderate Lifecycle Fund)

This Life cycle fund provides a capping of 50% of the total assets for equity investment. The exposure in equity investments starts with 50% till 35 years of age and gradually reduces as per the age of the subscriber

LC25 (Conservative Lifecycle Fund)

This Life cycle fund provides a capping of 25% of the total assets for Equity investment. The exposure in equity investments starts with 25% till 35 years of age and gradually reduces as per the age of the subscriber.

Pension Fund Managers (PFMs)

Subscriber is mandatorily required to choose one pension fund manager from the available PFMs.

- Birla Sunlife Pension Management Limited

- HDFC Pension Management Company Limited

- ICICI Prudential Pension Funds Management Company Limited

- Kotak Mahindra Pension Fund Limited

- LIC Pension Fund Limited

- Reliance Capital Pension Fund Limited

- SBI Pension Funds Private Limited

- UTI Retirement Solutions Limited

Procedure to register under NPS Vatsalya

As of now, the specific procedure to register for NPS Vatsalya is not yet finalised by the government. As the NPS Vatsalya was announced in Budget 2024, it is still in the process of finalizing the details and implementation of this scheme. Once the necessary infrastructure is in place, clear guidelines for registration will be released by PFRDA. You can check our latest article here for update on NPSV.

Once finalised, for registering under NPS Vatsalya one should visit official website of the Pension Fund Regulatory and Development Authority (PFRDA) or varous Point of Sales (POS).

Leave a Reply