We are now in an era where investing in sovereign government bonds is made simple through our online platform.

Types of Bonds:

There are various type of government bonds like :

- Government Bonds: Such bonds are issued by the Reserve Bank of India (RBI) on behalf of the GOI. They are considered very safe as they are backed by the government. Such bonds are called Sovereign bonds. Government bonds can be further divided into Treasury Bills, Government Dated Securities, and Sovereign Gold Bonds.

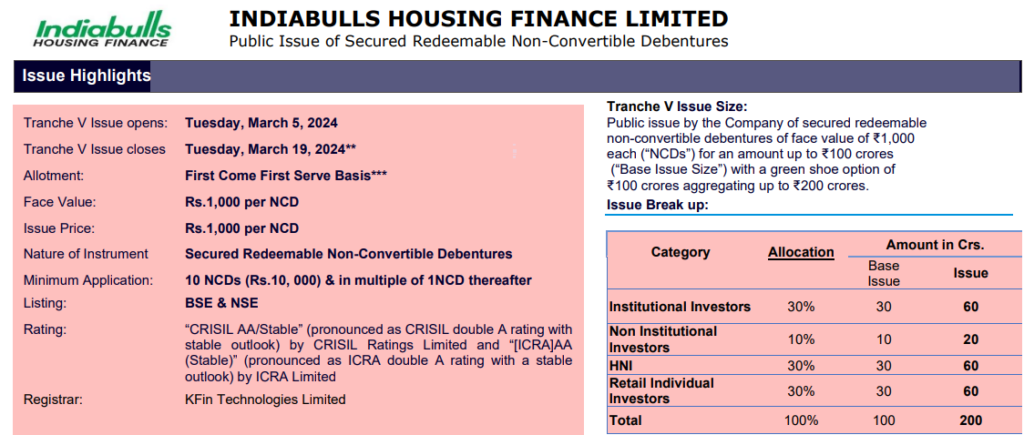

- Corporate Bonds: Such bonds are issued by companies to raise capital, these bonds typically offer higher interest rates compared to government bonds but come with higher risk. They can be further divided into secured and unsecured bonds.

- Municipal Bonds: These are issued by municipal corporations or local government bodies to fund public projects like infrastructure development. They are relatively less common but provide a good investment avenue with tax benefits.

- Tax-Free Bonds: Issued by government-backed entities like the Indian Railways Finance Corporation or the National Highway Authority of India, the interest earned on these bonds is exempt from taxation, making them attractive to investors in higher tax brackets.

- Fixed Deposit Bonds: Similar to fixed deposits in banks, these bonds are issued by companies and offer a fixed return over a specified period. They are not as liquid as other bonds but are popular for their predictable returns.

- Inflation-Indexed Bonds: These bonds help protect investors from inflation, as the principal and interest payments are adjusted according to the inflation rate. They provide a hedge against inflationary pressures.

- Perpetual Bonds: These do not have a maturity date and are often issued by banks to raise Tier 1 capital. They can be called by the issuer after a certain period, usually five years.

- Convertible Bonds: These can be converted into equity shares of the issuing company at a later date. They offer a blend of fixed income and potential for capital appreciation.

- Masala Bonds: These are rupee-denominated bonds issued outside India, primarily aimed at tapping the offshore investor base. They help companies raise funds in foreign markets without the risk of currency fluctuation impacting the principal and interest repayments.

It’s important to conduct thorough research or consult with a financial advisor to identify which high-yield bonds fit best with your investment strategy.

Factors such as the issuing company’s financial health, market conditions, and the bond’s maturity date should all be considered.

Incorporating high-yield bonds into your portfolio can provide a steady income stream and help you achieve long-term financial goals, making them a valuable component of a well-rounded investment approach.